For decades, banks have relied on paper-based documentation to manage everything from loan applications to customer account histories. The result? Vaults, basements, and off-site storage filled with boxes of sensitive financial data. While these records once represented stability and accountability, they now pose mounting risks and inefficiencies.

Physical records are expensive to store and difficult to access. There is also a financial burden with the cost of filing cabinets, banker boxes, and storage facilities. Then add to that the risk of loss due to fire, flood, or simple misplacement.

Banks today need agility, compliance, and instant data access - none of which paper can provide. This growing mismatch has pushed many financial institutions toward bulk document scanning, a strategic shift that enables long-term operational and compliance benefits.

What is bulk document scanning for banks?

Bulk document scanning refers to the large-scale digitization of physical files into searchable, secure digital archives. For banks, this process involves a combination of technologies including:

- Optical Character Recognition (OCR) for making text searchable

- Indexing and metadata tagging for quick retrieval by account number, date, or document type

- Cloud or on-premises storage integration for secure access and backup

Unlike simple image scanning, modern document digitization in banking leverages intelligent data capture to extract structured information that can integrate directly into existing systems such as core banking platforms or CRMs. This distinction turns digital archives into usable data assets rather than static digital images.

Why banks are turning to digitization

Banks are embracing digitizing financial records as part of broader digital transformation in financial institutions. The motivations are clear:

- Improved accessibility: Authorized employees can locate a file in seconds instead of hours.

- Operational efficiency: Workflows move faster when records are available digitally, enabling better customer experiences.

- Disaster recovery: Digital backups protect vital data from fires, floods, or deterioration.

- Regulatory compliance: Digital archives can be easily audited and managed under retention policies.

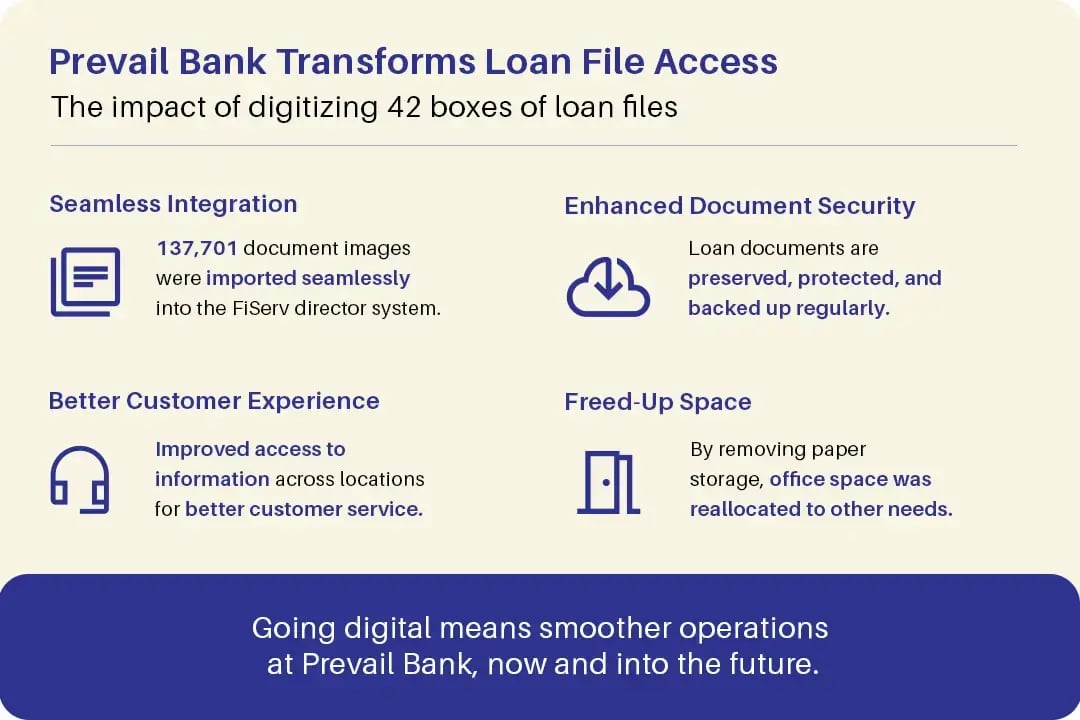

Digitization not only frees up space but also transforms how information flows across departments. To illustrate these benefits in action, consider the key results achieved by a leading Midwest bank after implementing a comprehensive digitization project.

For a more detailed analysis and to explore the full scope of the project, read the complete Prevail Bank case study.

Compliance and security considerations

Banking regulations, such as GLBA (Gramm-Leach-Bliley Act), FINRA, and FDIC recordkeeping requirements, place strict controls on how customer and transaction records are stored, accessed, and destroyed. Bank document scanning services are designed to support these document management obligations through secure, auditable processes.

Key security features include:

- Chain-of-custody tracking from pickup to digital delivery

- Encryption and secure data transfer during scanning and upload

- Certified destruction of paper originals post-digitization (with documented proof)

Partnering with a scanning provider experienced in secure document archiving for banks ensures regulatory alignment and minimizes compliance risk.

Operational benefits of document digitization

Once paper files are converted, the benefits extend across nearly every operational area:

- Faster audits and reporting: Compliance teams can instantly pull required records for FDIC or internal audits.

- Enhanced customer service: Front-line staff can retrieve documents immediately, reducing response times.

- Seamless system integration: Scanned data can connect directly with loan origination, CRM, or account management systems.

These efficiencies align perfectly with the needs of operations professionals who value speed, accessibility, and reduced manual workload.

ROI and long-term savings

The return on investment for bulk scanning is both immediate and ongoing. Banks typically see savings in three major areas:

- Reduced storage costs – eliminating off-site fees and freeing real estate for more productive use.

- Lower retrieval costs – less staff time spent tracking down paper files.

- Process efficiency – digitized workflows accelerate everything from loan approvals to compliance audits.

By digitizing records once, a bank eliminates recurring storage fees, reduces document-handling time, and gains a searchable, secure archive to support downstream process improvements.

What you can expect from a bulk scanning project

Transitioning from paper to digital doesn’t have to be overwhelming. If you choose the right vendor, the process should be easy and look something like this:

- Consultation and assessment – an on-site evaluation and in-depth discussion of your current filing systems, physical records, and document handling needs.

- Secure document intake and preparation – documents are securely transported and prepped to ensure optimal scanning results.

- Production scanning and quality control – production-level scanners process thousands of pages per hour with quality control options tailored to your requirements.

- Indexing and secure delivery – searchable digital documents are created and securely delivered.

If the document scanning vendor doesn’t follow a process like this, it’s worth asking a few more questions about their project timeline, proposal details, and process security.

Building a future-ready, paperless bank

As financial institutions pursue digital transformation, bulk document scanning represents a foundational step by transforming decades of static paper files into accessible, compliant, and actionable digital data.

By investing in document digitization, banks position themselves for greater efficiency, resilience, and security. The transition from paper to pixels isn’t just about modernization - it’s about empowering people and processes to operate smarter, faster, and more securely.

Ready to modernize your records management strategy? Contact us today to schedule a secure bulk scanning consultation and start building your paperless, future-ready bank.